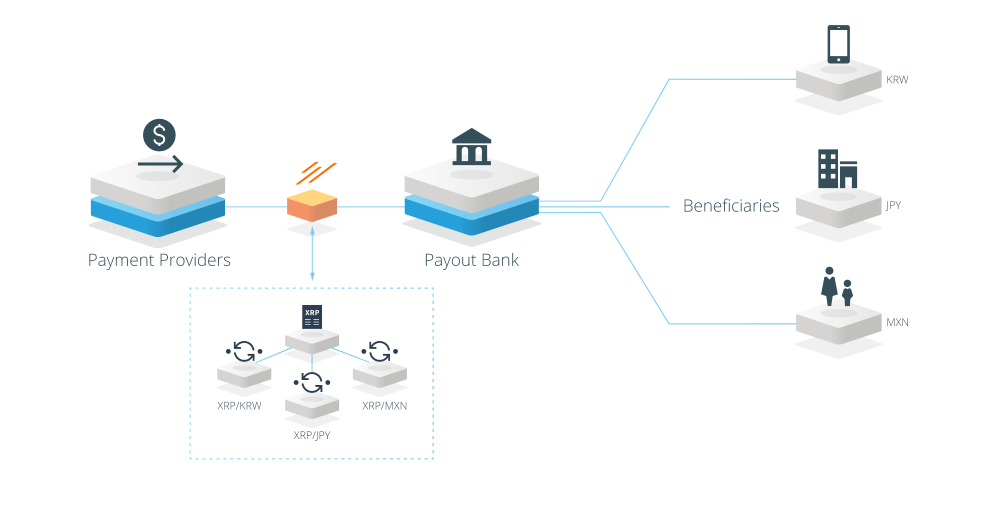

xRapid is Ripple’s cross-border payments product that minimizes liquidity costs, and it’s powered by high speeds, low transactions costs, and it also boasts high scalability of the token XRP.

In order to xRapid to become more successful, there has to be a healthy ecosystem of digital asset exchange partners around the world.

Such exchanges will allow xRapid payments to move from one currency to XRP and vice versa as quickly and efficiently possible.

Ripple announces three new partners

Ripple announced on their blog that Bittrex would be acting as the preferred digital asset exchange for xRapid transactions that move via US dollars.

Besides this, Bitso and Coins.ph will become the preferred for Mexican Pesos and Philipines Pesos.

Ripple also presents the exact flow of an xRapid payment from the U.S. to Mexico:

- A financial institution with an account on Bittrex will start a payment in US dollars via xRapid, and this will be instantly converted into XRP on Bittrex.

- The payment amount in XRP will be settled over the XRP Ledger.

- Bitso will instantly convert the XRP into fiat currency, and this will be settled into a particular bank account.

“Bittrex is one of the biggest names in digital asset trading in the U.S. The same goes for Bitso in Mexico and Coins.ph in the Philippines. That makes today’s announcement an important development for xRapid,” said Cory Johnson, Chief Market Strategist at Ripple.

“We’ve seen several successful xRapid pilots already, and as we move the product from beta to production later this year,” he continued.

Financial institutions that use xRapid saved up to 70%

Back in May 2018, Ripple revealed that financial institutions that are piloting xRapid saved 40-70% on average compared to traditional foreign exchange brokers who facilitate cross-border payments.

These payments have been settled back then in just 2 minutes or less compared to two or even three days that are required by traditional methods.