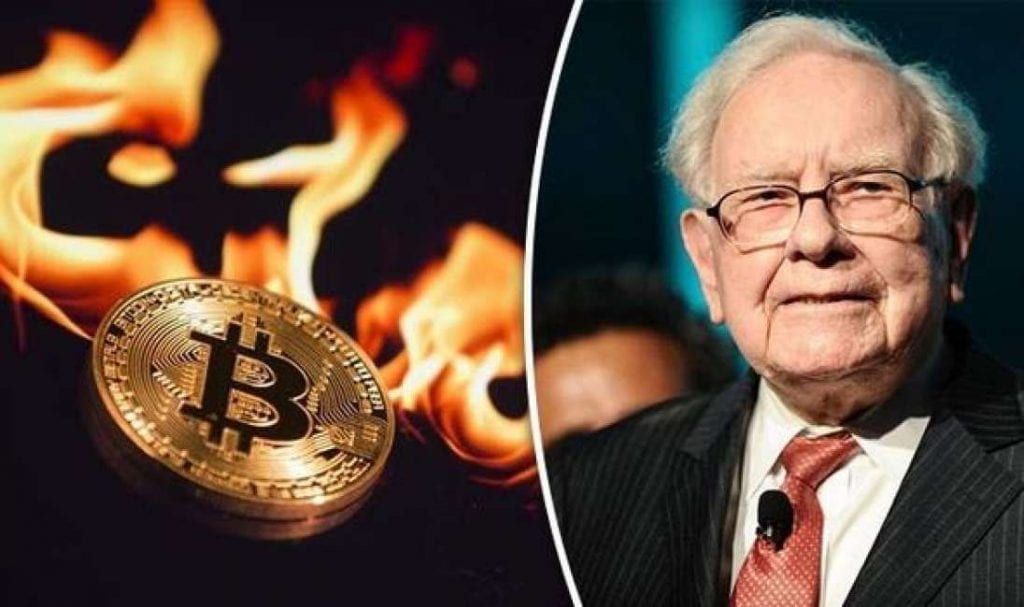

Everyone in the crypto space knows by now how Warren Buffet has constantly been slamming Bitcoin.

Now, in spite of Buffet, an unidentified crypto bull from Australia is betting millions of dollars that the Bitcoin’s price will exceed the share price of the Warren Buffet-headed investing conglomerate Berkshire Hathaway by 2023.

Tom Waterhouse, the chief executive officer of bookmaker William Hill Australia, claims that there’s an anonymous staker who made this AUD$8.5 million bet claiming that Bitcoin will be worth more than the price of Berkshire Hathaway Class A shares.

These are currently trading at $280,000 above BTC. He claims that this is bound to happen within five years or so.

This whole thing means that Bitcoin will have to appreciate by more than 40 times in the next few years.

Big Bet: Well known Crypto expert has just requested a bet of $8.5m AUD to win $1.2bn that a Bitcoin will exceed the price of a Berkshire Hathaway share (c.$280k) by 2023. Have put him in touch with large syndicate – hope he can get set! pic.twitter.com/C20AHzH2k9

— Tom Waterhouse (@tomwaterhouse) July 11, 2018

Buffet has been bashing Bitcoin for years

Buffet has been anti Bitcoin for several years now and back in April he said that dealing Bitcoin is similar to gambling because it has no returns other than the expectations that it could be offloaded at a higher price sometime in the future.

“If you buy something like a farm, an apartment house, or an interest in a business… You can do that on a private basis… And it’s a perfectly satisfactory investment. You look at the investment itself to deliver the return to you. Now, if you buy something like bitcoin or some cryptocurrency, you don’t really have anything that has produced anything. You’re just hoping the next guy pays more,” he claimed back then.

Buffet also said that Bitcoin is a bubble and he repeated similar phrases in more interviews, urging people to stay away from Bitcoin.

The crypto space has its own path

Regardless of Buffet’s hateful predictions, the crypto space has its very own plans and its own path to follow.

During the annual shareholder meeting of Berkshire Hathaway, Genesis Mining, a cloud mining giant put up billboards that were captioned with “Warren: You said you were wrong about Google and Amazon. Maybe you’re wrong about bitcoin?’ close to the billionaire’s offices in Omaha, Nebraska. You can see one below.

https://twitter.com/bulldogholmes/status/996874534245543936

In case you didn’t know, Buffet passed the chance to invest in the two giants mentioned above due to his skepticism and missed the opportunity to enjoy massive gains.