There have been a lot of crypto-related predictions these days, both optimistic and negative, as well.

Since the bulls came back to the crypto market, the optimistic predictions seemed to have flooded the space.

You may recall than less than a month ago, the bulls came back and boosted the price of BTC.

VanEck’s head of digital asset strategies Gabor Gurbacs addressed three main reasons for which the bulls were back in the crypto market:

“CME Bitcoin futures expired

President Xi Jinping supports blockchain in China.

Crypto Capital CEO arrested. Exchanges, such as Bitfinex, may get some of the seized 850 million back.”

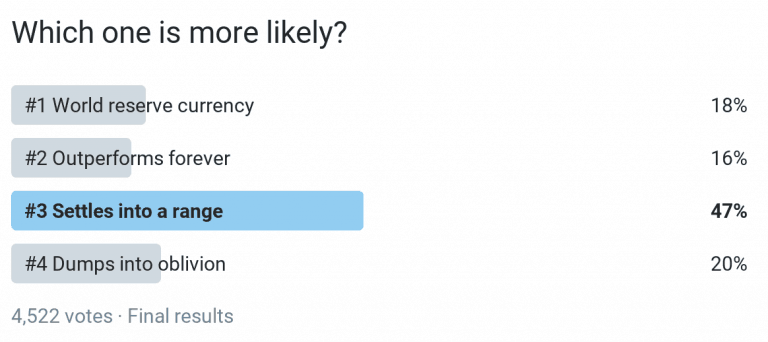

Alex Kruger releases a poll on four potential outcomes for BTC

Crypto analyst Alex Kruger released a survey on four possible outcomes for the most important coin in the market.

The online publication the Daily Hodl reveals that the crypto market has been plagued by “years of volatile price swings, regulatory uncertainty, bans, critics, supporters, new platforms, on-ramps, and developers.”

Three of the potential outcomes that we mentioned above are bullish, and Kruger’s final one is about the risky nature of trading BTC in the emerging and highly volatile market.

“Four long-term bitcoin scenarios:

#1 Bitcoin becomes a global reserve currency. Current hodlers, all proven to be early, get immensely rich.

#2 Scarcity keeps price going up forever. Bitcoin continues to outperform. Investors do extraordinarily well.

#3 After a few more epic runs $BTC eventually matures and settles into a wide range, like most commodities do (in real-terms). Bitcoin maxis turn into goldbugs 2.0.

#4 Bitcoin dumps into oblivion. People keep on buying the dip. Bitcoiners get REKT.”

What do you think the final outcome for BTC will be?

Speaking of BTC, the most important coin in the crypto market is currentrly trading in the red, and the coin is priced at $8,129.62 at the moment of writing this article.