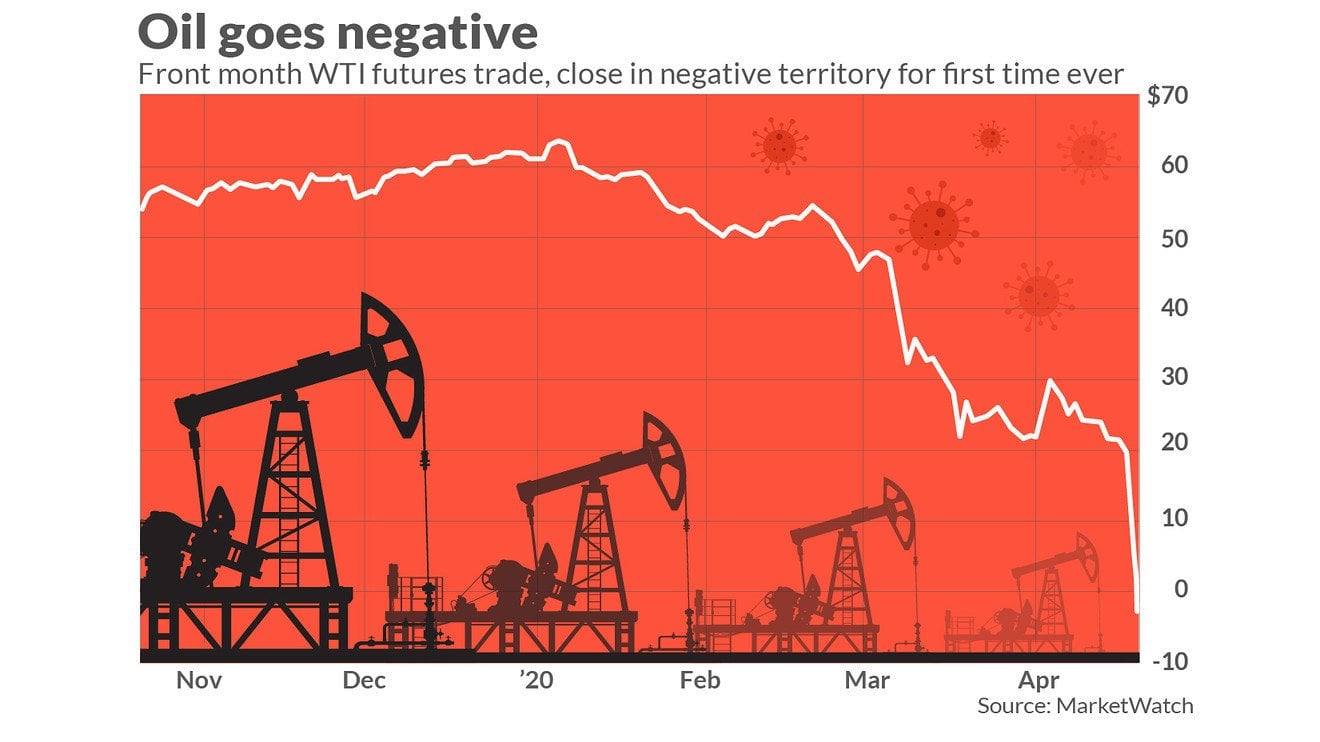

Oil managed to do something that shocked even the veterans in the markets. The oil market just crashed below zero and left everyone wondering.

“I’m not sure how to react to that other than say that nobody, whether they’re 120 years old or whether they’re 20 months old, has ever seen an oil price lower than this,” Tom Kloza, a 40-year market veteran and head of global market analysis for Oil Price Information Service, told MarketWatch.

This negative finish means that the holder of a long position will have to pay someone to take the contract off their hands. All of this is obviously happening due to the global crisis that’s been triggered by the coronavirus pandemic.

This move is emblematic of a historic bear market for oil, which is sinking by the collapse of demand – all of this as a result of the coronavirus outbreak and also due to the price war between the Saudi Arabia and Russia.

Crypto market vs. the oil market

You may already be aware of the fact that there are some crucial differences between three essential assets, gold, oil, and Bitcoin. But now, by the look of things, when it comes to comparing the crypto market to the oil one, it’s pretty clear who the winner is.

Crypto never traded on the negative side, unlike oil.

It’s also important to note the fact that even before the coronavirus kicked in, the oil demand was significantly dropping.

It’s pretty obvious that the travel ban and global quarantine have exacerbated all this to the point in which we are today.

MarketWatch writes, “The May WTI crude contract CL.1, -99.23% CLK20, -99.23% closed Monday at -$37.63 a barrel, a one-day drop of $55.90, or 306%, according to Dow Jones Market Data.”

Now, investors who have flooded into the oil markets are risking significant losses, according to commodity specialists.

The ETF that they are us9ing are swept up in the current market turmoil. According to FT.com, “The United States Oil Fund, the largest oil ETF known as USO, saw inflows of about $1.5bn last week, as US crude prices hit their lowest levels since the early 2000s on plunging demand.”

Professional traders have been trying to pick the turning point for oil, and they were confident that the market would recover quickly after the coronavirus-fighting measures got eased.

But this did not happen, and oil turned out trading at sub-zero prices.

The crypto market, as you already know, witnessed its own crash back in March when Bitcoin hit numbers below $4,000, but considering that today the most important coin out there is trading above $6,900, it’s safe to say that the crypto market witnesses a really quick rebound.

More than that, cryptos have never traded below zero.

As we keep reporting, all signs point to the fact that in the current scenery triggered by the coronavirus pandemic, Bitcoin and the crypto market will show their true potential, the main reason for which crypto was created.

Anthony Pompliano just said that these are the times that will push Bitcoin, and the global economic fallout will boost the crypto market to the moon.

Leave a Reply