Litecoin (LTC) reached its record value of 104.30 USD just yesterday (29/11/2017) and now is currently being traded at 78 USD. What should we think given this brutal change? Let’s do some math.

Litecoin had nearly a 2000% YTD (year-to-date) growth this year. Is this too much? Does it fall short from expectations? Currently this coin sits at #7 at coinmarketcap which means that the so called “Silver to the Bitcoin’s Gold” is not doing as well as expected, at least in theory.

Now is it really doing well? Let’s look at the 2017 stats.

Image 1: Litecoin’s Progress in 2017. Source: https://coinmarketcap.com/currencies/litecoin/

What does this tell us? Look at the prior peak in September. The truth is that Litecoin’s slide of 25% today could only be the beginning of a much major crash of 50% like it was in September. And it might not stop at a 50% crash and be even more mind-blowing. The September crash tells us another thing, that it’s common amongst crypto-currencies for a big run to be followed by a big crash. This is where the math kicks in, look at what happens after every single crash up to date. The price of the crypto seems to only stabilize when it reaches the value that was before the boom. The best part of it all? This seems to be the worst-case scenario!

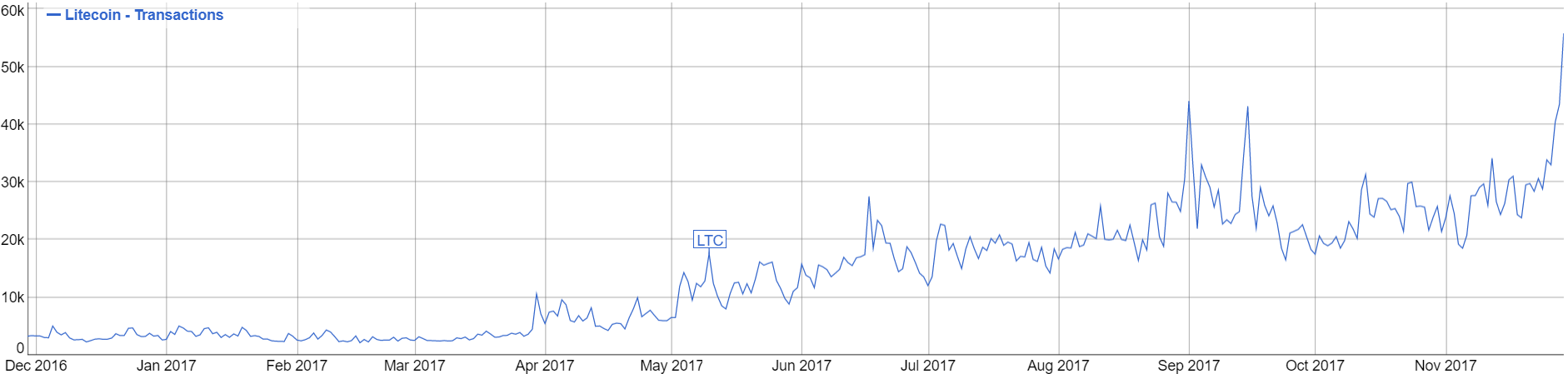

Image 2: Litecoin’s unique transactions per day in 2017. Source: https://bitinfocharts.com/

Looking at the transaction volume chart in Litecoin we get different numbers. We see that in January we have around 2K unique transactions per day. We currently have almost a 3000% growth in transactions volume. I guess the 2000% increase in value doesn’t seem so high now.

Litecoin’s Vision

Litecoin seems to have the advantage of coming closer to the vision of replacing fiat as form of currency. This is not only a matter of opinion, information manipulation lets us believe that bitcoin is indeed awesome but despite the current frenzy we see that bitcoin has its limitations. Bitcoin started being as stated on its white paper that it was supposed to be “A Peer-to-Peer Electronic Cash System” but due to its particularities society now sees it not as an Electronic Cash System but as an effective and profitable way to store value.

You might think that this means that bitcoin failed its purpose but never forget that a project like this can have multiple interpretations and multiple applications. The technology doesn’t stop to be impressive because it is viewed in a different way.

Charlie Lee kept this vision alive and didn’t allow Litecoin to become subject of interpretation. So instead of saying that Litecoin is the new and better Bitcoin (like everyone did at every Hard Fork ever), Charlie said he wanted to create a bitcoin fork that in his opinion served him and society better. He introduced Atomic Swaps, he forced Litecoin’s entry in every major Exchange and continues to believe in this own project. And this is where Litecoin is ahead of the others, the sense of vision is not yet lost, a fan of Litecoin usually stays a fan of Litecoin.

Another important topic is the community. Bitcoin unchangeable Software structures means that there’s not much to add there, the community is vastly based on miners and users. Litecoin has a community behind it of Developers and people wanting to contribute to the project.

Lessons to learn

This momentary crash is only coming in accordance with what we already believe, Volatility. Once we do the math and look at the stats we see that for a project like this in #7 is way too low for Litecoin. We have 2 Bitcoin hard forks that represent little to no addition in terms of applicability of Bitcoin ahead of Litecoin in coinmarketcap. This shows just how the markets opinion is vastly manipulated which in consequence creates these infinite cycles of boom-crash and the so-called FUD (Fear, Uncertainty & Doubt). Litecoin is really trying to be the “Silver to the Bitcoin’s Gold”.

In short, when I first entered the crypto world there were two phrases that really moved me and I would like to share them:

“Time in the market beats timing in the market.”

And another one that does not only apply to crypto currencies but to world in general.

“When there’s blood on the street, buy property.”

Please don’t be let yourself be influenced or manipulated and don’t let FUD drive your investment decisions.