Bitcoin is only 10 years old, but it has caused enough disruption in the global financial landscape, triggered hearings in Congress, given traditional financial institutions sleepless nights, and announced an alternative financial order. The underlying Blockchain technology that powers Bitcoin has given us Smart Contracts, Decentralized Autonomous Organizations (DAOs), and Decentralized Exchanges (DExs) among others.

Bitcoin’s speedy rise to prominence and its zero correlation to traditional assets already suggests that the cryptocurrency might displace gold from its safe-haven status to become the preferred store of value during periods of economic uncertainty. This piece examines some of the salient factors surrounding the safe-haven narrative of Bitcoin.

Bitcoin has its roots in a recession

Bitcoin was launched in 2009 soon after the 2007/2008 global economic meltdown as a form of money that exists outside the control of the government and its agents. The first written record of Satoshi Nakamato’s work appeared in a cryptography mailing list two months after the Lehman Brothers filed for bankruptcy. Satoshi says “I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party…” and that idea has crystallized into what we know as the cryptocurrency market today.

Recessions are typically bad for everybody – the prices of assets crash, businesses default on their obligations, consumers have a scarcity mindset, and financial institutions witness liquidity shortages triggered by “irrational” herd actions. Some events of the last few years such as the China-US trade war, politico-economic risks in Europe, and lack of socio-economic momentum in Africa is driving growing concerns about a 2020 recession.

In August, analysts at Morgan Stanley warned that the risk of a global recession is high and rising “…and we will enter into a global recession (i.e., global growth below 2.5%Y) in three quarters.” While Bitcoin has mostly been non-correlated against market events that move traditional assets, the true test of its covariance will be seen in the next global recession.

How did Bitcoin fare during currency crises in the past?

Since Bitcoin had its debut in 2009, the world has recorded economic downturns in about seven countries. The relative performance of the cryptocurrency during these economic downturns, in turn, provides some insights into how it is likely to fare in the event of a global economic recession.

Cyprus

Take the banking crisis that happened in Cyprus in 2013 as an example; many Cyprians lost faith in the country’s financial system because Cyprian banks were fraudulently buying Greek government bonds. At the height of the Banking Crisis in April 2013, the price of Bitcoin had jumped more than 300% in just two months.

In a research note about the Cyprian Bank Crisis, Nicholas Colas, CMO at ConvergEX observed that “the bottom line here is that incremental demand for Bitcoin is coming from the geographic areas most affected by the Cypriot financial crisis — individuals in countries like Greece or Spain, worried that they will be next to feel the threat of deposit taxes.” The relative decline in the price of gold and Cyprus Economic Sentiment Indicator in the same period further supports the safe-haven property of Bitcoin.

Greece

Greece has been largely indifferent to Bitcoin and cryptocurrencies until the country experienced an economic crisis that laid bare how much control the state apparatus had over people’s wealth and livelihoods. The history of the Greek debt crisis could be traced back to 2010 when Greece threated to default on its debt and undermine the viability of the EuroZone.

In the following years, private investors and the EU have loaned Greece about 320 billion Euros and the country is scheduled to continue repaying debts until 2060. In return, Greece has had to adopt austerity measures, which in turn saw many social services being trimmed.

The debt crisis peaked in June 2015 when Greece held a referendum on leaving the EU and there were fears that the Euros that people have stored in banks could be devalued if the country returned to Drachmas. The Greek government then attempted to prevent a panic bank run by ordering a week-long closure of banks. But it was already too late. People started buying Bitcoin, BTCGreek.com recorded a 400% surge in signup that week, and Greece got its first Bitcoin ATM a few weeks later.

The closure of banks and the realization that a government policy might be all it takes to lose wealth stored with traditional financial institutions triggered an increase in the demand for Bitcoin in the country.

Venezuela

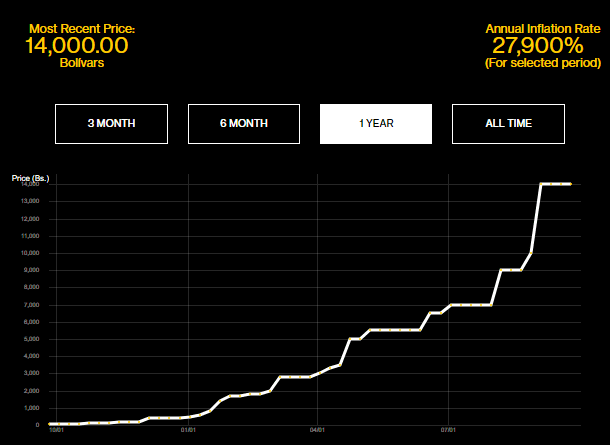

In the most recent case, the Venezuelan economy is still in a downturn. The Venezuelan crisis has its roots in political uncertainty and economic mismanagement. Yet, the average Venezuelan bears the brunt of the burden with hyperinflation that has peaked to an annual rate of 27,900% in the last one year as measured in the Venezuelan Café Con Leche Index which tracks how much it costs to buy a cup of coffee in Caracas.

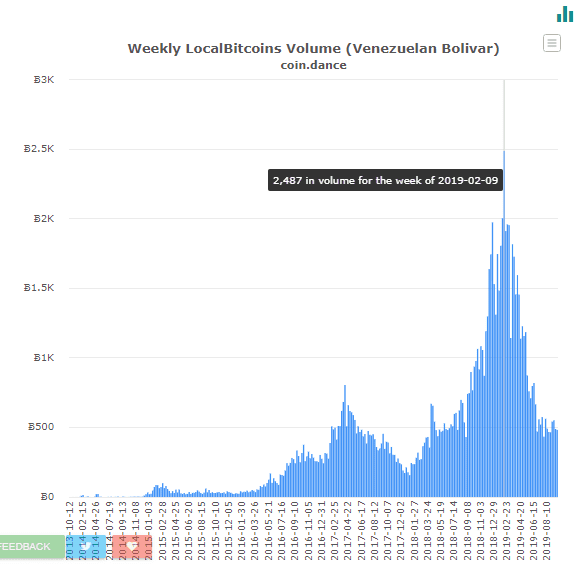

About 3 million people have fled the country in search of greener pastures, but for 27 million people who still call Venezuela home, Bitcoin is a better store of value than the Bolivar. In the week ending September 7, the trading volume of BTC in Venezuela was 2,487BTC worth about $2.9M worth of BTC per day (at current price).

3 risks that could affect the safe-haven status of Bitcoin

Market Risk

One of the factors that could impact negatively on the safe-haven property of Bitcoin is its market risk. Bitcoin is highly volatile and speculative; there’s not much guarantee that Bitcoin will hold its value after the recession ends, Hence, people that fail to time the recession properly might end up losing significant value in their crypto holdings.

Security Risk

The second risk that could reduce the appetite for Bitcoin as a safe-haven asset is the security risk posed by the irreversible nature of Bitcoin transactions. Bitcoin, once stolen, practically can’t be retrieved. Unfortunately, Bitcoin is fully digital, and the digital space is teeming with malware, hackers, and outright exchange exit scams.

Regulatory Risk

Lastly, there’s still the regulatory risk that might prevent Bitcoin from unlocking mass-market adoption as an alternative to fiat currencies. The current regulatory uncertainty is slowing down the active participation of institutional investors and the long-term liquidity, legal tender status, and liquidity of Bitcoin will continue to be questioned until there’s active participation from states and institutions.

Conclusion

From the foregoing, one could assume that investors will potentially flock to Bitcoin for security in times of economic uncertainty. However, Bitcoin is still considered a high-risk speculative asset and from a behavioural finance standpoint, high-risk assets tend to be the first to be liquidated in times of market turmoil. Investors could be more confident risking a part of their resources in cryptocurrencies during a general bull market, but they might not hesitate to run for the exits in a global economic meltdown.

Until Bitcoin experiences and survives a global financial meltdown, every analysis of how it is likely to perform in a recession still falls under the genre of speculation. Nonetheless, the fact that Bitcoin recorded increased adoption in the cases of economic crises in individual countries suggests that it has decent odds of being a safe-haven asset in a global financial crisis.