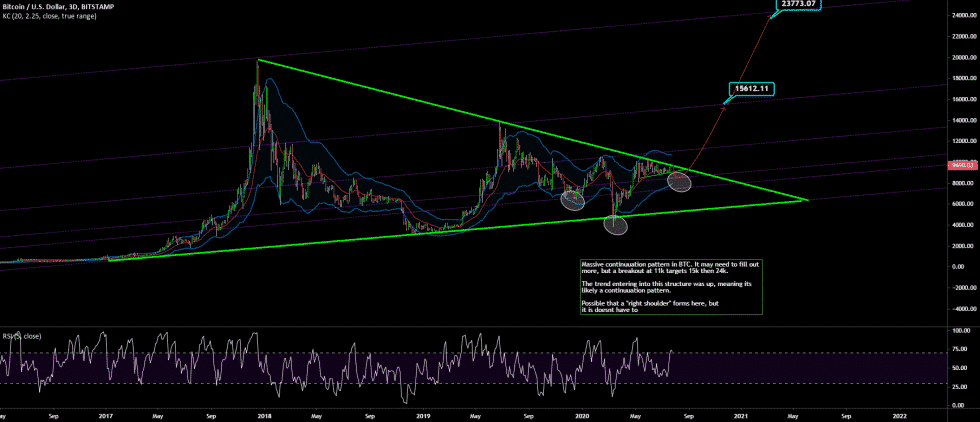

Bitcoin is expected to get to $15,000 valuation in the next sessions, according to full-time futures trader Adam Mancini. The trader said earlier today that BTC and USD closed above a ‘multi-year bullish triangle’ by nearly $2,000.

The two assets’ huge move above the ‘continuation pattern’ enhanced BTC’s probability of testing short-term breakout targets, starting with $15,000. Moreover, Bitcoin could extend its growth towards $24,000 as well, Mancini said.

“[The cryptocurrency] may be the new kid on the block, but the same old classic patterns that apply to all financial assets still apply,” he tweeted. “[The] trend is up with 15k next target.”

The bold bullish move followed a relatively latent weekend. It also occurred simultaneously with a drop in Chinese stocks as investors analyzed the latest U.S. sanctions against China, which include a punitive action on Carrie Lam, Hong Kong’s leader. China’s CSI 300 dropped 0.8 percent while Hong Kong’s Hang Seng went up by 1 percent.

#Bitcoin up as tensions rise in Asia

Capital flight out of Asia taking the #Bitcoin express

You can’t take it with you, unless it’s Bitcoin – then you can take IT ALL with you

(Something near impossible with Gold)

— Max Keiser (@maxkeiser) August 10, 2020

Inflation Misfortunes

Bitcoin’s price growth also appeared as Morgan Stanley cautioned about ‘a burst of inflation’ in the United States. The Wall Street bank’s equity strategist, Mike Wilson also stated that the Federal Reserve’s belligerent fiscal and monetary response to the ongoing global crisis pushed its M2, a benchmark measure of U.S. money supply, to an unprecedented high.

“While we are likely to experience big imbalances in the real economy for several more quarters, if not years, the most powerful leading indicator for inflation has already shown its hand — money supply, or M2,” he told FT.

In the meantime, gold, which is referred to as the second-best to bonds, has risen to its all-time high. The precious metal’s price grew above $2,000 an ounce for the first time, registering a 36 percent increase in price on a year-to-date period.

Bitcoin Demand

It appears that Bitcoin, whose economical aspects are similar to that of gold, is playing catch-up with the safe-haven asset. Its shortage against the unlimited U.S dollar supply has gotten it the name of ‘digital gold.’

He added: “11 years into the #bitcoin timeline, we’ve reached an Inflection point where the likelihood of large (institutional). BTC orders coming in to Buy are more likely than large orders coming in to Sell. Remember, it took ~ten years for paper checks and credit cards to go mainstream.”

Ronnie Moas expects Bitcoin to grow to $26,000 by next year.