As the ecosystem of tokens/cryptocurrencies continues to evolve and progress, a good question to ask when presented with a listing such as the one you see when opening the page at coinmarketcap (https://coinmarketcap.com/coins/views/all/) is: What are the potential (and real life) use cases for some of the tokens listed? And do they have a shot at being game changers, or are they simply a speculative gamble? Or perhaps both? With that in mind, today we will focus on two payment systems which might warrant a closer look.

XRP

Ripple (XRP) attempts to connect banks, payment providers, digital asset exchanges & corporates via their own blockchain known as RippleNet. Ripple has a common ledger that is managed by a network of independent validating servers that constantly compare their transaction records. It supports tokens representing many types of units of value even including frequent flier miles and mobile minutes.

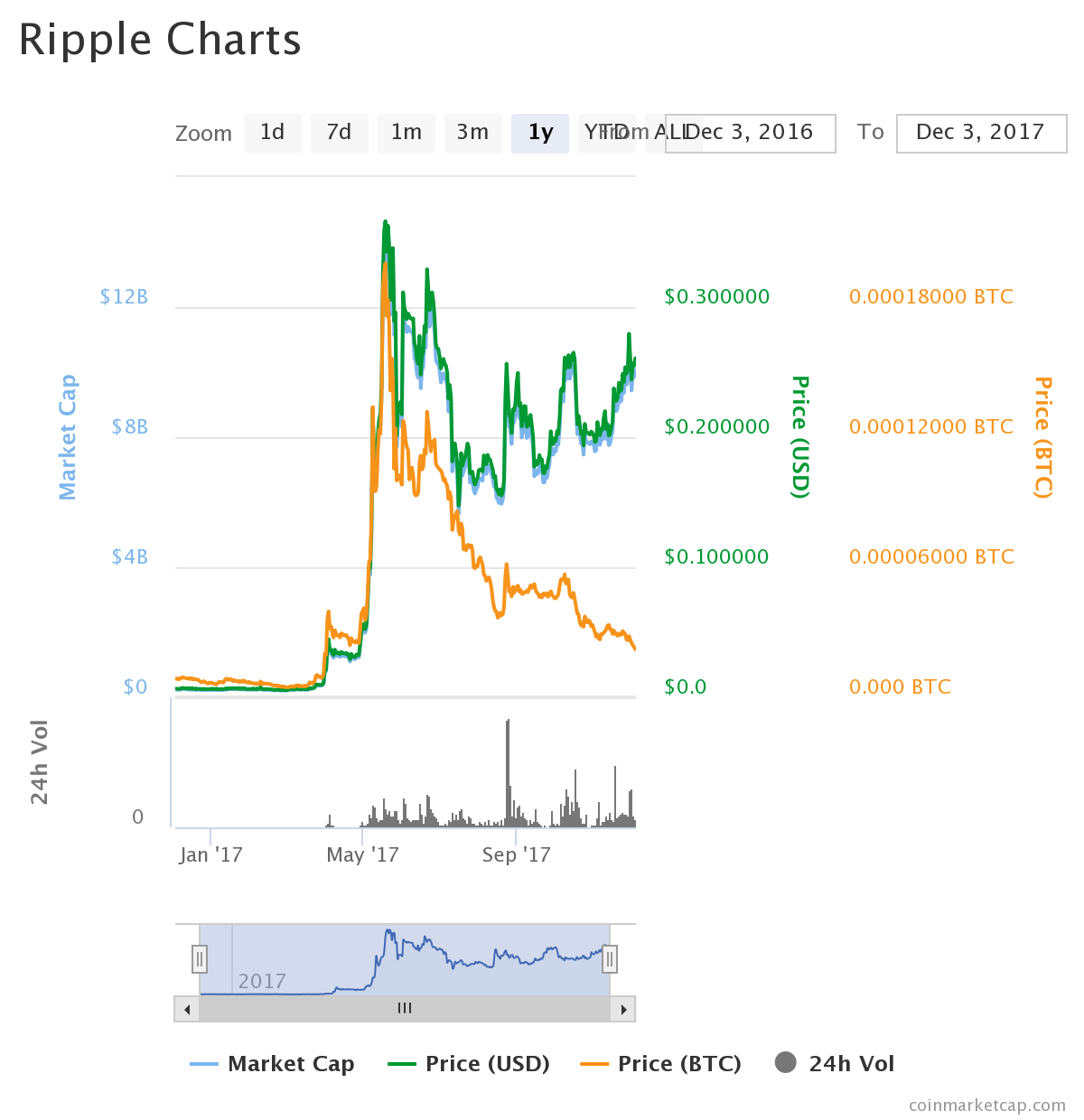

Ripple has focused on the banking market in an effort to offer an alternative remittance option to consumers, allowing real-time cross border payments for retail customers, corporations, and banks. Cross River bank of New Jersey and CBW Bank in Kansas were among the early adopters of the Ripple protocol, and in December 2014 Ripple partnered with Earthport , a global payment services system which boasted such heavyweight clients as Bank of America and HSBC. Since then, the names on the Ripple list continue to grow and many are familiar ones. With a market cap approaching 10 billion, Ripple is firmly in the number 4 spot behind only BTC, ETH, & BCH and appears to have a strong road map for real life use cases and growing adoption.

From Wikipedia: “As of April 2017, members of the network known as the Global Payments Steering Group (GPSG) are Bank of America, Merrill Lynch, Canadian Imperial Bank of Commerce, Mitsubishi UFJ Financial Group, Royal Bank of Canada, Santander, Standard Chartered, UniCredit and Westpac Banking Corporation. The group will “oversee the creation and maintenance of Ripple payment transaction rules, formalized standards for activity using Ripple, and other actions to support the implementation of Ripple payment capabilities”

XLM

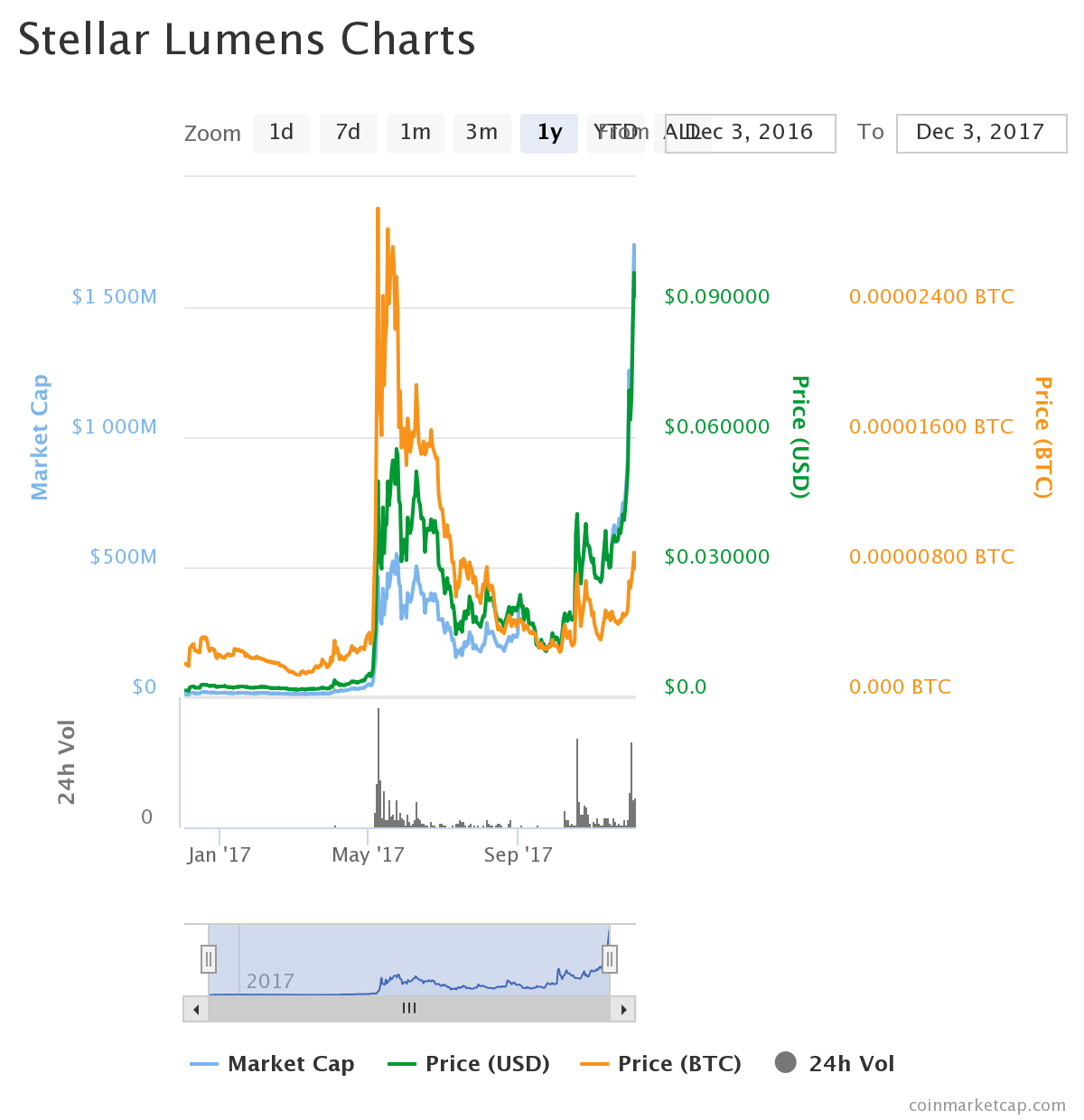

Next up is the Stellar protocol. The laudatory name notwithstanding, it is an open source protocol for exchanging money and is supported by a non profit, the Stellar Development Foundation. At launch, Stellar Lumens (XLM) was based on the Ripple protocol. After making several changes to critical consensus code, the Stellar network forked. In the aftermath, Stellar co-founder Joyce Kim claimed[26] this was a flaw in the Ripple protocol but this statement was challenged in a blog post by Ripple Labs CTO, Stefan Thomas.[27]

The Stellar Development Foundation then created an updated version of the protocol with a new consensus algorithm, based on entirely new code. The code and whitepaper for this new algorithm were released in April 2015, and the upgraded network went live in November 2015.

Stellar users are recommended to use a base account and an issuing account. Issuing accounts are intended to be the intermediary pool between the base account and customer’s accounts. Aiming to become a worldwide payment standard, the SDF has its sights set on creating an affordable financial system where people of all income levels can access simple-to-use, secure, and low cost financial services.

In October 2016 and again in August 2017, SDF conducted lumen (XLM) giveaways to BTC and XRP holders with a goal of encouraging bitcoin and ripple holders to explore and use the Stellar network, as well as encourage exchanges to support lumen trading. As more people with lumens transact on the network, it will become more useful to those who build low-cost services on it.

Lumens that were not claimed by during the Bitcoin program are currently going to the Stellar Build Challenge and toward the operations of SDF. The Stellar Build Challenge rewards development, education, usage, and integrations in the Stellar ecosystem by awarding lumen to the creators of useful technologies, resources, and applications. For more information, please refer to the Stellar Build Challenge page

As the march toward ‘blockchain-everything’ continues, networks such as Ripple and Stellar Lumens may find their niche and demonstrate strong value as payment networks, even as scalability issues with other currencies continue to be worked out, both on and off-chain. Exciting times, indeed.